“Grand Lessons” for Early-Stage Founders

By: Tim Streit

Earlier this summer, I had the opportunity to join Michigan Founder’s Fund for their Spring Retreat in Saugatuck, Michigan. Thanks MFF for including me and for the 9 amazing founders who made the trip, shared their stories, and asked some great questions. I thought it might be helpful to jot down some notes and observations from our Q&A to share with others. I’ll start with some background, then get into Q&A, combined with some of the frameworks we use.

Background: To start, I shared a little bit of my background and upbringing to add some context for why I moved back to Michigan in 2010 and what motivates me. Early in my career, I got burnt out working long hours as an investment banker in Chicago. In 2003, I was asked “Who are your role models, and what do I want to leave as my legacy in life?” Reflecting on my childhood in suburban Detroit, with parents who were teachers, and my grandfather, a Lutheran Pastor in Detroit, I realized my family’s legacy was helping others. As I thought about where I could have the biggest impact helping others, I decided I wanted to move to Michigan one day to start a venture fund focused on helping founders to create the next generation of Michigan companies, jobs, wealth, and culture.

Over the last ~15 years, I’ve realized that for the mission to succeed and scale, we must also generate top tier returns for the investors (aka limited partners) in my funds. If we use a 3–4x cash on cash return, that equates to a 20–30% IRR.

I share this with founders so they know:

- There is a whole community pulling for you, that wants you to succeed, and understands the importance to you and to the world.

- For Grand to generate those types of returns for LPs, we only select a very specific type of business, which I’ll outline below.

- For founders, the key to fundraising is to find the right investors that share your interest and can help you achieve your shared objectives. VCs, angel investors, PE groups, and family offices often have different interests, return thresholds.

Question 1: What do you look for when meeting a founder/company for the first time?

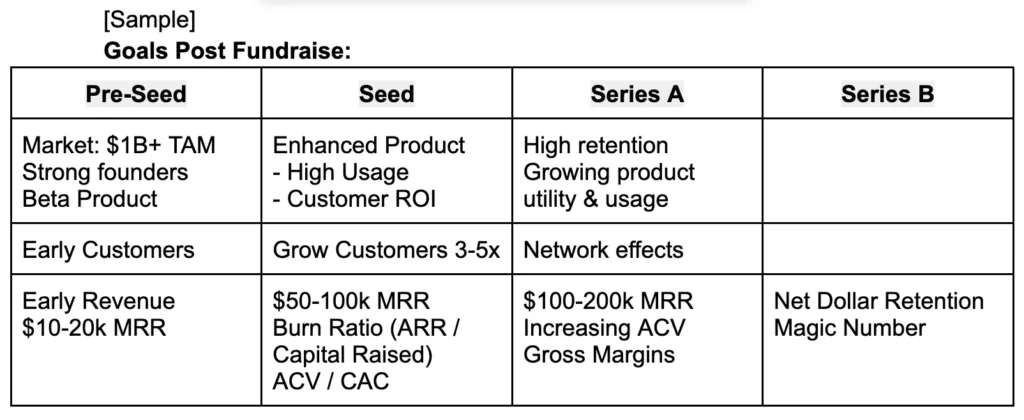

The first big step in having a great first meeting with a venture capital firm is to ensure they are focused on and excited about the sector that they work in. VCs tend to focus on one or more specific sectors, stages, and geographies. About us: Grand Ventures is an $80M fund investing in seed stage Fintech, Digital Health, DevOps, and Supply Chain companies, typically based in fast-growing regions of the US and Canada. Our sweet spot is leading $3–5M seed rounds with a $1–2M check. For us, seed stage typically means there is at least $10–20k MRR and starting to see signs of product market fit. One useful framework that I learned a long time ago in a marketing class, and adapted for venture capital, is the 3Cs and 4Ps framework.

The 3Cs are: Customer, Company, Competition

The 4Ps are: Product, Price, Promotion (marketing), Place (geography)

There are entire text books dedicated to this framework and case studies so I’m just going to highlight some key things I look for when meeting founders for the first time.

- Customer is the first C for me every time. The best founders have an intense focus on their customers, the problem they’re going to solve, and the value proposition that will 100x outcomes for customers. Demonstrating subject matter expertise will be evident in how they have designed their product and the user experience for customers.

- “Related” to customers, is also Market . For early-stage VCs that are expected to drive a 3–4x Cash on Cash return, the “power law” of venture suggests that 10–20% of our investments will create 80% of our returns. For Grand, we’re looking for businesses that if they reach at least a $1 billion valuation, with 5% ownership, would represent a $50 million return, or a “fund returner” on our $50 million Grand Ventures II.

- ***Note: Right alongside Customer, Company is the next most important “C” topic. We had some great conversation over dinner about company topics including founding teams, culture, and balancing mental health in this delicate sprint/marathon called “startups”. I’m going to save these themes for a future post since I’m already on the topic of VCs and fundraising. But stay tuned for more!

Question 2: A related question that I’m often asked “What are some of the biggest misconceptions that founders have when raising funds from VCs?”

Some founders have misconceptions about the required returns for VCs, the underlying return thresholds for investments, and how it impacts our diligence and investment decisions.

I share the target returns and assumptions in the prior paragraph to illustrate the point that many seed stage VCs, including Grand, are focused on companies with $1B potential, or “Unicorns”. Why? Because the only way we can generate the returns our investors require is to find the outsized winners. Many of us get into VC to make an impact for founders, and we love to do that, but the VC model scales if we can generate exceptional returns for our investors. As an eternal optimist, I love almost every founder and business I see when first introduced. I want “you” to win. I believe in you. But because of the return thresholds, oftentimes our fund will pass on investing if we can’t see the potential outcome needed for our portfolio construction strategy. That’s not to say we are “right”. So as a founder don’t lose hope. Just try to take all feedback as an opportunity to think through potential obstacles and improve your odds of success!

Question 3: Where can you find VCs interested in your industry?

There are lots of resources out there to help find the right VC for your journey! In the early days of building your company, before revenue starts to scale, oftentimes local angel groups and regionally focused funds are tailored to meet the needs of local startups. This is usually a great place to start. Per the prior comments, most VC funds publish their sector and stage focus, so spend some time researching them in advance. Lots of websites publish lists like “Most active investors in _____ (sector/geography)”. Once you connect with a VC, ask for more referrals. VC is a pretty tight industry with only a few thousand firms nationally, and often times < 50 in a given geography, so we typically know what our peer firms focus on. In fact, most of our best deal flow comes from other funds who know what we look for and have worked with us in the past. Look for events and conferences focused on your sector. Those will be filled with other start-ups and VCs that share your passion. Find other companies that have been successful focused on a similar customer group, value prop or go to market model, and research their VCs. VCs that have had success in a given sector, stage, geo are more likely to back similar companies, as long as they aren’t directly competitive.

Question 4: When is the best time to fundraise?

The best time to fundraise is when you reach important milestones and are starting to grow your key performance indicators (KPIs = revenue, customers, etc). Here’s why… Venture capital, in many ways, is a game of calculated risk taking. There are always unknown aspects about a business. Is the problem real? Can the product be built? Can the CEO recruit a great team? Will customers care and be willing to pay? How will they scale revenue? Over time, as companies grow they answer these questions, mitigate risks, and demonstrate a more predictable future, with growing revenue, known expenses, and a more credible product road map, that increasingly creates a differentiated product and valuable company. One of the big unknowns is how much time and money it will take to answer “questions” and mitigate risks. If companies run out of capital before they find the answers, they may not be able to raise more capital, and potential value is lost. VCs don’t expect you to answer all of the questions at once. The questions just change from stage to stage. The best time to raise capital is when you’ve achieved the appropriate milestones for your stage, start to grow fast, and have a reasonable plan with the use of funds, to achieve the next phase(s) of milestones.

While these stages and milestones are somewhat subjective, and will vary based on the sector and business model, the idea is that there is a continuum of milestones as a company grows. And the best time to grow is when you start accelerating toward the next phase.

This is particularly important because a) the only way businesses reach $1B “unicorn status” and the reason VCs invest in tech companies, is because they have the potential to scale exponentially. VCs are keen to invest, when it appears you’re entering a phase of exponential growth.

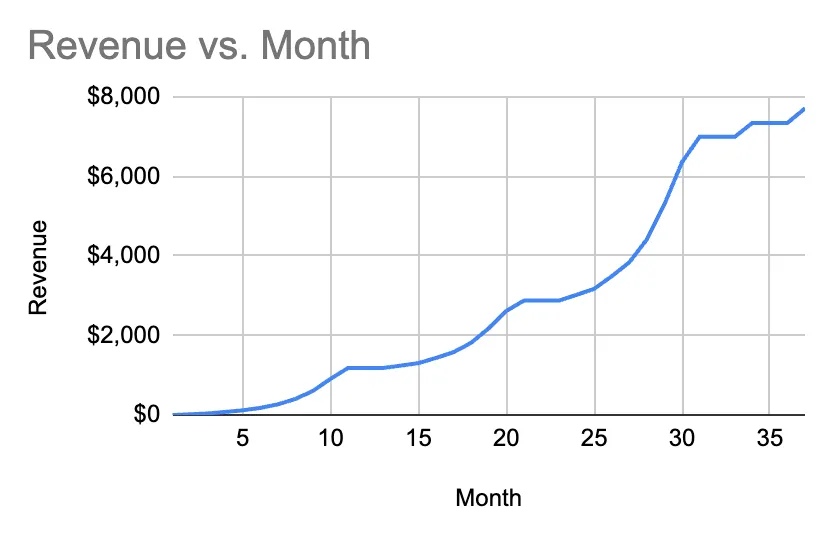

In reality, most businesses experience periods of exponential growth, followed by plateaus, as they overcome the next phase of hurdles, and then start to grow exponentially again. It’s much harder to fundraise when companies plateau and growth starts to slow. Reality:

(Tim Streit Google Sheet special — if anyone wants to use it)

Question 5: When scaling your company, what are some practices that founders should consider to ensure that they are prepared for the next phase of growth?

I share the chart above as a bit of a roadmap for the different phases of growth. The CEOs job is to have a strategy for how to achieve the next phase of growth. In many cases, the next phase of growth may be a little unclear, in which case you should seek guidance from investors and advisors.

My question: “What are the CEOs top 2 jobs?” (think about it)

My opinion: a) Not run out of money; b) Hire a great team.

So more importantly than seeking guidance, the CEOs #1 job is surround yourselves with team members who have been through this next phase of growth.

“Try to hire people that you think might be stronger/smarter than you”.

Some founders and employees are great at $0-$1M ARR. Others great from $1–10M ARR. And the skillset from $10–50M ARR is often quite different. So find the right leaders for each phase of growth in key functional areas: product, tech, marketing, sales, customer success.