Why We Invested in Piere

Ushering in the Era of Self-Driving Money

By: Tim Streit

At Grand Ventures, we invest in startups building novel solutions and enabling technologies that power the next generation of financial services, especially those serving underserved markets at scale. Our investment in Piere aligns with that strategy and represents a bold bet on the future of autonomous personal finance. Its intelligent financial operations engine doesn’t just track spending or surface recommendations—it takes action. Like cruise control for your money, Piere is pioneering a new paradigm: “self-driving money.”

Reimagining Personal Finance for the 80%

While most modern PFMs (personal finance managers) are built for the top 20%, those with assets to manage, investments to rebalance, and brokers to consult, Piere is going after the underserved 80% of consumers who need guidance, not dashboards. This includes working-class and middle-income families navigating the complexity of fragmented benefits, debts, subsidies, and paycheck cycles.

Instead of obsessing over AUM or conversion to brokerage accounts, Piere is focused on actionable, automated money movement—making sure bills are paid, goals are met, and dollars are optimized. In doing so, the company is creating a differentiated wedge in a crowded space and unlocking massive latent demand.

Proprietary Tech and AI Agent Infrastructure

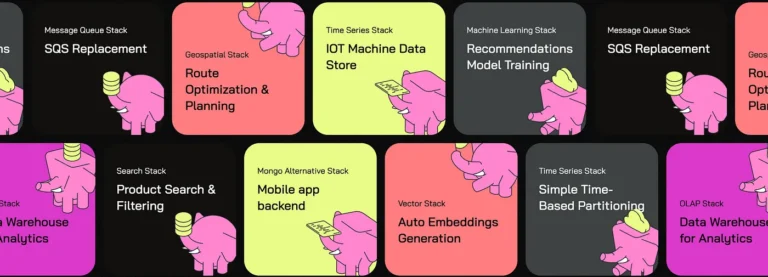

What sets Piere apart is its deeply technical architecture. The company has built a modular AI agent framework and proprietary orchestration engine that allows it to intelligently route funds, execute financial tasks, and adapt to changing user needs, all while maintaining transparency and trust.

While others rely on static rules or scripted nudges, Piere’s system continuously listens: to shifts in a person’s finances (such as changes in cash flow, account balances, or new obligations) and to the broader market (like evolving regulations, interest rates, and incentives). It adapts in real time, acting like a financial planner, bill negotiator, and benefit navigator, only faster and at scale. It’s this infrastructure-first mindset that gives us confidence in Piere’s ability to serve both individual consumers and enterprise partners over time.

An Enterprise Flywheel in Motion

While the consumer product is core to the Piere experience, what’s most exciting is how consumer trust is catalyzing enterprise adoption. Piere has attracted inbound interest from large-scale partners like the National Foundation for Credit Counseling, the largest financial counseling organization in the US (3M users), and Progressive Insurance (1M users), organizations looking to integrate Piere’s capabilities into their own customer experiences.

These pilots are more than logos; they represent the early stages of a distribution flywheel, with institutions bringing millions of users into the ecosystem. One particularly strategic investor, TruStage – which sells into over 95% of U.S. credit unions – has invested in Piere, recognizing that its members will increasingly demand embedded financial agents like Piere’s.

Founder-Market Fit: Yuval’s Vision and Execution

Piere’s vision is big, but it’s grounded in execution. Founder and CEO Yuval Shmul Shuminer brings a rare combination of technical fluency, analytical rigor, and customer empathy. Reference calls consistently highlighted her ability to build trust with users and stakeholders alike. She is data-driven yet mission-oriented, a leader well-positioned to navigate both the consumer and enterprise sides of this opportunity.

In a market filled with noise, Yuval has built clarity. In a space riddled with dashboards, she’s building automation. We believe she’s not just creating a company, but defining a category.

Why Now

We are living through a generational shift in consumer expectations, where AI-driven agents will increasingly manage aspects of daily life, from transportation to scheduling to financial decision-making. No one owns the “self-driving money” category yet, but we believe someone will. Piere has a real shot at being one of the winners.

We’re thrilled to welcome Piere to the Grand Ventures portfolio. This company aligns perfectly with our thesis around AI-native infrastructure, embedded fintech, and the rise of autonomous services for the masses. Here’s to building a future where managing your finances doesn’t require mastery, just trust.

—

Thanks to the Piere team for partnering with us, and to @jacqueline-lensing for her hard work helping source and build conviction around the opportunity (not to mention her handiwork drafting this blog!)